What is Falling Wedge Bullish Patterns EN

Content

- How to trade Forex and binary options with the Wedge pattern

- SafePal Price Prediction: What Does The Falling Wedge Pattern Mean For SFP?

- How to trade the Descending Triangle pattern?

- “Every Candlestick Patterns Statistics”, the last trading book you’ll ever need!

- DOGE Transaction Volumes Jump As Musk Floats Crypto Payments During Twitter Meet

- Trading Advantages for Wedge Patterns

Notably, crypto has changed the financial world significantly, but we cannot overlook the harm it has caused to the environment. Cognizant of this fact, the IMPT project aims to increase the efficiency of the carbon credit market. Many investors in the crypto market are looking for the next big thing in cryptocurrency. While there are many contenders for the title “most promising altcoin,” Calvaria and IMPT are the ones to watch this month and into 2023.

- As with the rising wedges, trading falling wedge is one of the more challenging chart patterns to trade.

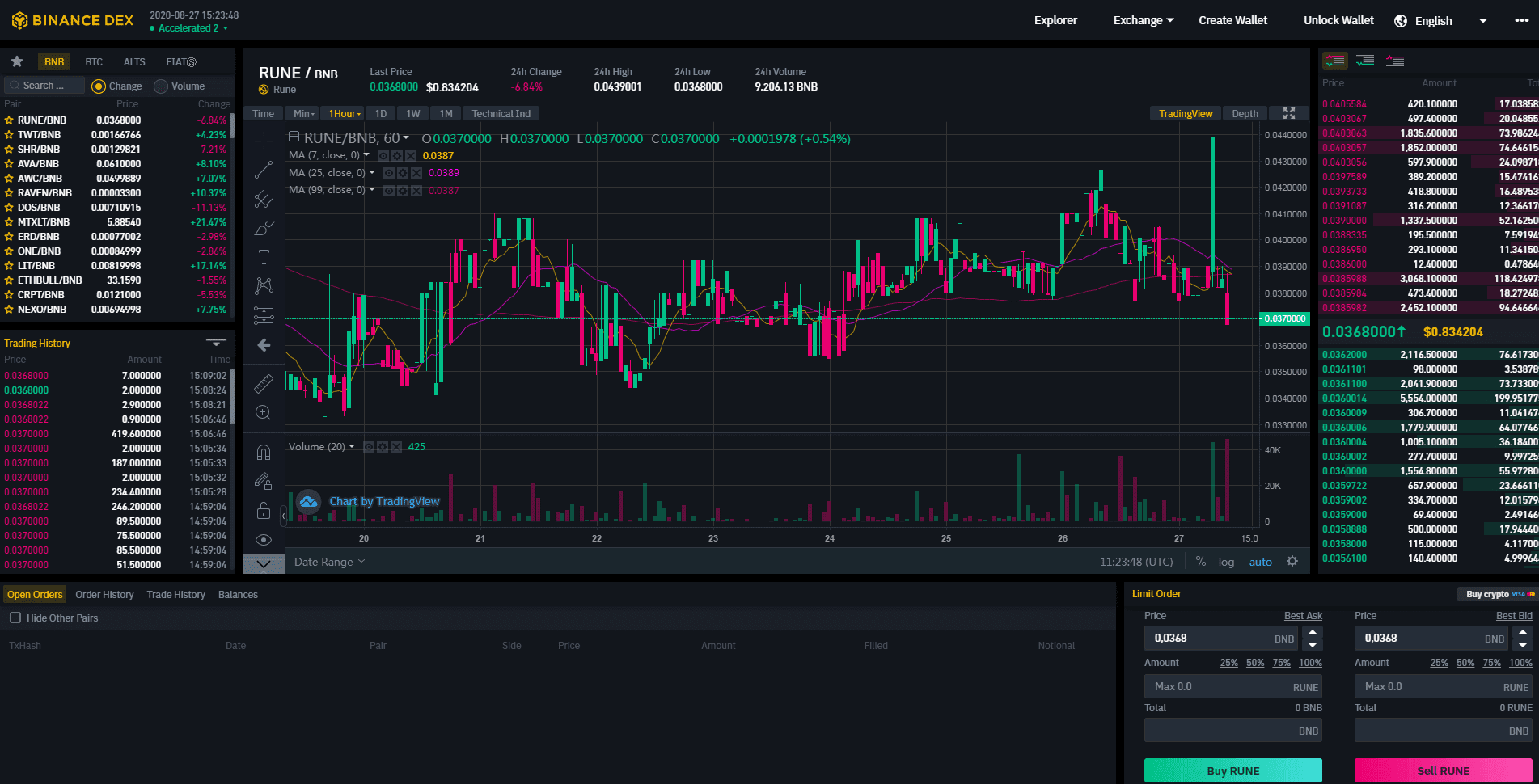

- In this technical chart, it is clearly visible how a falling wedge pattern is being formed by the price movement of the currency pair.

- To trade the ascending wedge, you take the opposite action to a falling wedge.

- In terms of its appearance, the pattern is widest at the top and becomes narrower as it moves downward, with tighter price action.

- I have also included must follow rules and how to use the BT Dashboard.

- Both scenarios contain different market conditions which must be taken into consideration.

- Though, while ascending wedges lead to bearish moves, downward ones lead to bullish moves.

Put simply, waiting for a retest of the broken level will give you a more favorable risk to reward ratio. It all comes down to the time frame that is respecting the levels the best. Because the two levels are not parallel it’s considered a terminal https://xcritical.com/ pattern. The illustration below shows the characteristics of the rising wedge. This follows a move by early investors to flock and purchase the IMPT altcoin at cheaper prices before it lists on exchanges in seven days and the price goes higher.

How to trade Forex and binary options with the Wedge pattern

Another common indication of a wedge that is close to breakout is falling volume as the market consolidates. A spike in volume after it breaks out is a good sign that a bigger move is nearby. It ultimately make an apex , but wedges trade very differently than standard triangle patterns.

In the article, I used images taken from the Olymp Trade trading platform. This is a platform supporting 2 types of trading including Forex and binary options . Register now for yourself an Olymp Trade Demo account in the box below to get acquainted with the Wedge pattern. Rising and falling wedges are only a minor component of a transitional or main trend. Falling wedges often come after a climax trough (sometimes called a “panic”), a sudden reversal of an uptrend, often on heavy volume. Determine significant support and resistance levels with the help of pivot points.

SafePal Price Prediction: What Does The Falling Wedge Pattern Mean For SFP?

Hence, this also forms an opportunity to take long positions in the market. With the progression of prices, volumes traded show a decline in numbers. There is a MainNet and it planned to launch until 15 December 2020! A step by step guide to help beginner and profitable traders have a full overview of all the important skills (and what to learn next 😉) to reach profitable trading ASAP.

USD/CHF has just broken out of the falling wedge pattern, meaning the outlook on the currency pair is now stro… http://t.co/dNv0PjZ0sf

— Afrikfx.com (@Afrikfx) May 12, 2014

The image below shows an example of the stop loss placement in relation to the falling wedge. As should be clear, it’s placed slightly below the support level, to give the market enough room for its random swings. Instead of going long as the market breaks out to the upside, they wait for the market to revisit the breakout level, ensure that it holds, and then decide to enter the trade. This way you reduce the risk of falling victim for as many false breakouts, as you first check if the market really respects the breakout level. Coming from a bearish trend, most market participants have bearish outlooks, and expect the market to continue falling. This also holds true at first, when the market forms the first highs and lows of the pattern.

How to trade the Descending Triangle pattern?

The Falling Wedge pattern is a valuable trader’s tool that signals an approaching bullish momentum. This article describes a technical analysis approach to trading the Falling Wedge and explains the key points when trading this pattern. One benefit of trading any breakout is that it has to be clear when a potential move is made invalid – and trading wedges is no different.

Btc RSI looks way overbought and macd weekly crossing up whilst ema's looking to golden cross printing a buy and go to the beach signal into a falling wedge pattern, meaning only one thing.. I have no idea what I'm talking about.

— dwainpipe (@dwainpipe0) March 30, 2022

The falling wedge chart pattern is a recognizable price move. It is created when a market consolidates between two converging support what is a falling wedge pattern and resistance lines. To create a falling wedge, the support and resistance lines have to both point in a downwards direction.

Otherwise you run a huge risk of trading patterns that stand no chance whatsoever. This isn’t the case with a wedge, where both lines should be falling or rising, depending on if it’s a falling or rising wedge. Most of the time you should aim to have a risk-reward ratio of at least 2, in order to stay profitable. This means that every profitable trade should be twice the size of any losing trades. This ensures that you stay profitable, even if 50% or more of your trades results in losses.

The descending wedge pattern appears within an uptrend when price tends to consolidate, or trade in a more sideways fashion. The falling wedge pattern occurs when the asset’s price is moving in an overall bullish trend before the price action corrects lower. The consolidation part ends when the price action bursts through the upper trend line, or wedge’s resistance.

“Every Candlestick Patterns Statistics”, the last trading book you’ll ever need!

LINK set off to $22.5 after last week’s falling wedge pattern breakout. To trade a broadening wedge, you don’t look for a breakout beyond either the support or resistance line. Instead, most traders look to take advantage of the oscillations within the pattern itself to earn a profit.

Trading chart patterns are an important aspect of cryptocurrency trading and have always been a vital part of forex trading. Not only do they help analysts figure out which stock is weak and which is strong, but they also help them figure out when to buy or sell. Several patterns exist that help them identify these positions. Support and resistance lines help them find these patterns on charts. A falling wedge is a chart pattern formed by drawing two descending trend lines, one representing highs and one representing lows. In this technical chart, it is clearly visible how a falling wedge pattern is being formed by the price movement of the currency pair.

DOGE Transaction Volumes Jump As Musk Floats Crypto Payments During Twitter Meet

The upper trend line should have a minimum of two high points with the second point lower than the previous and so on. Similarly, there should be at least two lows, with each low lower than the previous one. Putting the breakout aside, the 50-day Simple Moving Average was LINK’s immediate support. If it stays in place, LINK may soon resume the uptrend above $16 and make way towards the target at $22.5. In light of the bullish sentiments, more resistance would be projected at the 100-day SMA, currently holding at $18, $20, and the 200-day SMA.

Wedge patterns have converging trend lines that come to an apex with a distinguishable upside or downside slant. Wedge-shaped patterns in particular are considered significantly important indicators of a plausible price action reversal, which can prove to be beneficial during trading. On the contrary, a bearish symmetrical triangle is an example of a chart pattern that exhibits a continuation of the downtrend. The action preceding the development of the symmetrical triangle has to be bearish for the triangle to be termed bearish.

Trading Advantages for Wedge Patterns

This means that the distance the market can move gets smaller and smaller the further it moves into the wedge. Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Spot Gold and Silver contracts are not subject to regulation under the U.S. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to Forex.com or GAIN Capital refer to GAIN Capital Holdings Inc. and its subsidiaries.

74-89 % of retail investor accounts lose money when trading CFDs. Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position.

Falling wedge

More often than not a break of wedge support or resistance will contribute to the formation of this second reversal pattern. This gives you a few more options when trading these in terms of how you want to approach the entry as well as the stop loss placement. Both the rising and falling wedge make it relatively easy to identify areas of support or resistance.

However because these wedges are directional and thus carry a bullish or bearish connotation, I figured them worthy of their own lesson. One of the continuation chart patterns is the symmetrical triangle pattern, wherein two intersecting trend lines link a set of peaks and troughs to create this pattern. In order to achieve an equal slope, the trend lines should be intersecting. This particular chart pattern implies a period of consolidation before the prices break out. Since the rising wedge pattern has a particularly distinct configuration, it can advise traders and investors to look out for impending top and reverse prices.

Wedge patterns are frequently, but not always, trend reversal patterns. A wedge pattern refers to a trend of the market on an analysis chart which is often observed while trading assets, such as bonds, stocks, crypto, etc. This pattern is distinguished by a narrowing price range combined with either an upward or a downward price trend. A wedge is a chart pattern marked by converging trend lines on a price chart. The pattern consists of two trend lines that move in the same direction as the channel gets narrower until one of the… Therefore, it is imperative to stick to the predefined stop loss in any trade.

Bir yanıt yazın